Contents:

This allows business owners to take well-informed decisions for their firm’s growth instead of waiting for the month end to proceed with key financial decisions. Although finances can be tracked by uploading snaps, if the business account is not linked to the accounting app, certain business transactions may not get tracked automatically. Examples include fees for an email marketing providers or web hosting, payment for social ads, etc. which are emailed to the business owner. Although accounting software integrates bookkeeping processes, there’s a difference between the terms “online bookkeeping software” and “online accounting software”. DEAR Systems delivers a centralized outlet that covers almost every facet of your business — from buying to warehouse management to job costing. That wide array of equipment includes a robust suite of accounting features that can enable any small business to streamline procedures like data entry and syncing invoices.

- Because of its extensive integrations, scalability, and feature set, we recommend QuickBooks Onlineto small businesses, mid-size businesses, and startups.

- Payroll is crucial to get right, and growing companies can be consumed with payroll if they don’t have automated software to help.

- Therefore, the development of the software requires professionals with thorough knowledge of finance.

- OneUp might be adequately known for its inventory management capacities.

- Docyt is a unique multi-functional accounting tool that automates your entire back office.

Bookkeepers lay the groundwork for accountants to analyze the data and create the various financial statements out of the – balance sheet, income statement, cash flow analysis, etc. If the bookkeepers’ numbers are inaccurate, so will be the financial reports. Duplicate invoices, overpayments and miscategorised expenses – there are many things that can go wrong with a company’s finances. That becomes all the more difficult when trying to check for those errors manually. And that’s before you even have to rework a tax filing or financial statement after finding an error once an error.

Benefits of accounting automation software

For example, all invoices are created, verified, submitted, approved, and paid for within a single dashboard. Not just that, with “role-based access” individual stakeholders can address challenges on the go. Having said that, here are some core bookkeeping tasks that can be automated easily. The key areas of bookkeeping that need automation depend on the accounting solution a business is currently using. Because accounting and taxes are interrelated, bookkeeping errors lead to severe tax complications, which ends up being very expensive for him.

Chaser Wins Small Business App Partner of the Year at Xero … – Newswire

Chaser Wins Small Business App Partner of the Year at Xero ….

Posted: Thu, 20 Apr 2023 18:00:00 GMT [source]

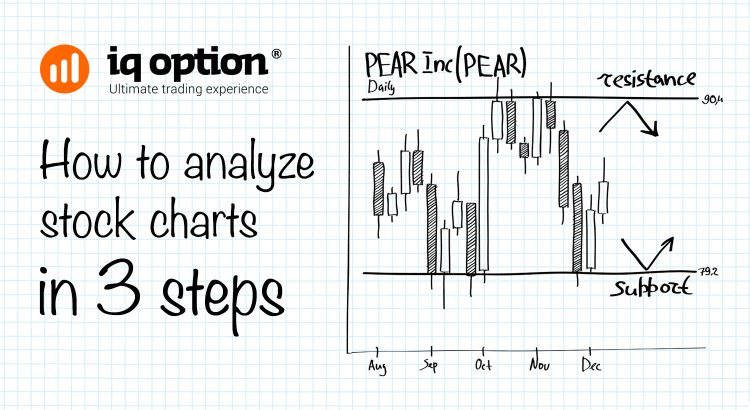

It delivers you with quantities that can enable you to figure out where to cut expenditures or invest more. Also, with an obvious overview of your current financial state, you will formulate smarter strategies and allocate aid more efficiently. The accounting automation platform is a key element of an ERP system. Most of its services are free, comprising invoice- and transaction management. Nonetheless, if you are looking for inventory tracking, built-in time tracking, or project management, you will need different software. Normal secure backups are included, and a mobile app enables you to keep track of your industry at all times.

Automated AR & AP

There are also tools that automatically collect client sales data from e-commerce and point-of-sale systems . These types of solutions are ideal both for brick-and-mortar businesses and the ever-rising number of businesses that operate online. Data entry is a slow, mundane task that eats up countless hours, particularly during tax season.

In addition, automation tools can generate reports and visualisations that make it easier to analyse financial data and make informed decisions. By reducing the possibility of human mistake, automating your procedures with a payroll application may provide you piece of mind. Payroll automation is a function of certain accounting software systems, but other payroll tools, such ADP or SurePayroll, can also do the work. Features for payroll automation will keep track of an employee’s hours, compute their compensation, compute payroll tax amounts, and produce paychecks. Once business owners provide the accounting app with their bank details, it will automatically scan the credit card and bank account statements and then upload them into an expense tracking system.

Can Artificial Intelligence Ever Become an IT Team Leader?

You can control who has access to your accounting data and what they can do with it. There has been a big push for businesses to automate as many tasks as possible. We use automated transaction syncing to update your books every day.

Automation also offers an upgrade to cash flow management and makes filing taxes exponentially easier. You can track receipts and taxes as well as maximize deductions by using an automated accounting tool. Data security is a critical concern for businesses of all sizes, and automation can help you maintain a higher level of security for your financial records.

Automating the AR & AP is the go-to way to free up cash flow and reduce human dependency. Efore we begin, let’s go back to the basics of bookkeeping and find the gaps which were overlooked for a long time. Even after you’ve gone live, it’s crucial to monitor the process and ensure everything is working. Costs will vary depending on your chosen features and your business size. Subscription & Billing Everything about billing, pricing, and subscription management.

Are We Panicking Yet? These 11 Jobs Could Soon Be Replaced by AI and Bots – Cheapism

Are We Panicking Yet? These 11 Jobs Could Soon Be Replaced by AI and Bots.

Posted: Mon, 24 Apr 2023 15:09:31 GMT [source]

Accounting automation can be used in many different situations, from small businesses to large corporations and even government agencies. The main goal is to provide companies with a more efficient way of handling their finances, so that they can concentrate on other aspects of running their business. If you’ve previously done your bookkeeping manually, you probably already set aside some time every week or month to take care of your books. You can add a third step to these Zaps to also send this information into your accounting software. To add a step, simply click the plus sign after your spreadsheet step.

Expertise Accelerated as Your Bookkeeping Partner

For example, if you use QuickBooks Online, several bookkeeping tools can integrate with QuickBooks and automate tasks like invoicing, expense tracking, and payroll. With accounting automation, business owners can breathe a sigh of relief and rest assured that their books are in good hands – without manually doing any of the hard work. In manual bookkeeping, the bookkeeper needs to update the accounts.

Its mobile compatibility is an even greater advantage, especially in hybrid workplace environments. From basic bookkeeping to invoicing to estimates to accurate reporting, FreshBooks is all about optimization. Linking business accounts to reputable accounting software is essential. Implementing automated bookkeeping comes with some minor drawbacks.

10 Jobs AI will KILL in 2023 – Observer Voice

10 Jobs AI will KILL in 2023.

Posted: Sat, 15 Apr 2023 02:43:16 GMT [source]

The important thing is to find what works best for your days sales in inventory and to keep tweaking and adjusting until you get it right. After doing a few trial runs, you can go live with your accounting automation. Bookkeeping automation is a team effort and should involve the whole bookkeeping and finance team.

For instance, most tools like Envoice will have a free trial period that you can use to test out the features. When choosing the right software for your business, it’s essential to consider your specific needs and requirements. This lack of security can lead to severe consequences for your business – like fraud or identity theft. With the sensitivity of financial data, it’s essential to have proper security measures to protect your accounting documents.

QuickBooks is continually updated with features such as project management functions. Scheduled invoices split transactions, and automatic sales receipts are further differentiators for QuickBooks. But if you really do want a bookkeeping solution that runs itself, you can get close with a combination of software and services.

With ZipBooks, you get billing and invoicing features such as payment reminders and auto-billing to reduce your admin work. You can also use their competitive intelligence to create data-driven verdicts about your finances. One of the major distinguishing characteristics that set Sunrise apart from the different tools on this list is its plans that comprise dedicated bookkeeping services.

Too advanced for small businesses that only require basic bill payment features. OneUp might be adequately known for its inventory management capacities. The program automatically modifies your inventory levels as they change and tells you when to reorder. No built-in ‘Debtor Chasing’ method so industries will require to manually follow up on unpaid invoices.

Recent Comments